Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| Check the appropriate box: | ||

| ||

| o | Preliminary Proxy Statement | |

| ||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ||

| x | Definitive Proxy Statement | |

| ||

| o | Definitive Additional Materials | |

| ||

| o | Soliciting Material Pursuant to Sec. 240.14a-12 | |

(Name of Registrant as specified in its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | ||

x | No fee required. | |

| ||

| o | Fee paid previously with preliminary materials. | |

| o | Fee computed on table | |

|

| |

|

| |

|

| |

| ||

| |

|

|

|

|

| |

| |

| |

|

| |

March 16, 202014, 2022

Dear Fellow Shareholder:

YouOn behalf of the Board of Directors, we are cordially invitedpleased to invite you to attend First Horizon National Corporation’s 2020our 2022 annual meeting of shareholders. We will hold the meetingshareholders, to be held at 8:00 a.m. Central Time on April 28, 202026, 2022, in the Auditorium of the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee 38103, at 10:00 a.m. local time.38103.

Transformation has been First Horizon’s theme for 2019. The company has continuedIn order to have strong loanprovide the proxy materials to our shareholders in an expedited manner while significantly lowering the costs of delivery and deposit growth across key markets and in specialty areas, and revenue growth and expense management have created profitability. Achievementreducing the environmental impact of our cost savings goals has enabled usannual meeting, we are furnishing these materials to make significant investments in technology and talent. Our sharpened focus on efficiency and agility will support our announced expansion into key markets in North Carolina, Virginia and Georgia through the acquisition of 30 branches, expected to be completed in second quarter 2020. In 2019, we unified our family of companies under the First Horizon brand, and our new brand promise puts understanding into action as we work to advocate for our customers. Finally, our upcoming merger of equals with IBERIABANK Corporation, expected to be completed in the first half of 2020, will create a leading regional financial services company with an expansive 11-state reach in high-growth, attractive markets across the combined company’s footprint. Even while accomplishing these strategic transformations, First Horizon has continued to receive recognition as a great banking organization and a great place to work. Highlights of 2019 include:

As First Horizon embarks on its 156th year, our Firstpower culture, with its emphasis on Accountability, Adaptability, Integrity and Relationships, continues to help us meet the challenges that we face. We are proud that First Horizon was recently named to the 2020 list of America’s Most JUST Companies, ranking third overall among banks. The inclusion of First Horizonshareholders on the JUST 100 list recognizes that financial performanceinternet at https://ir.firsthorizon.com/financialdocs. You will receive a notice with instructions for accessing the materials and positive contributionsvoting via the internet in addition to society can go hand-in-hand. The strengthinformation about how to obtain paper copies of our culture and the quality of our people have also been reaffirmed with top-employer recognition from Fortune, Forbes, Phoenix-Hecht, the National Association for Female Executives, the Bloomberg Gender-Equality Index, the Dave Thomas Foundation for Adoption, and Working Mother Magazine. Our Corporate Social Responsibility report,Herefor Good, highlights our commitment to all our stakeholders—communities, employees, customers and shareholders.

Accompanyingproxy materials if you would prefer. Following this letter are the formal notice of the annual meeting our 2020 proxy statement and our annual report to shareholders, which contains detailed financial information relating to our activities and operating performance during 2019. Though it is being delivered to you with our2022 proxy statement, the annual report to shareholders is not “soliciting material” under SEC Regulation 14A.

At the meeting, we will ask you to elect twelve directors; to vote on an advisory resolution to approve executive compensation (“say on pay”); and to ratify the appointment of KPMG LLP as our independent auditors for 2020.statement. The accompanying proxy statement contains detailed information about these matters.on the matters to be voted on at the annual meeting.

Your vote is important. You mayWe encourage you to vote your proxy by telephone overor via the internet or, if you received a paper proxy card by mail, you may also vote by signing,

dating and returning the proxy cardit by mail (as directed on the proxy card).mail. Even if you plan to attend the meeting, please vote your proxy by telephone or over the internet or return your proxy card as soon as possible.

In order to accommodate those attending, we ask that you let us know of your plans to attend by so indicating when you vote. Registration and seating will begin at 7:30 a.m. Central Time. We will ask you to sign in and present valid photo identification (or other identification acceptable to the company) as well as proof of ownership acceptable to the company, such as an appropriate brokerage statement. If you are the legal representative of a shareholder, also bring proof thereof. Cameras and recording devices will not be permitted at the meeting. For the health and safety of all meeting attendees, if you have not been vaccinated against COVID-19, we ask that you wear a mask and practice social distancing. Though not required of vaccinated individuals, we encourage everyone to wear a mask and practice social distancing where possible.

Thank you for your continued support of First Horizon and I look forward to seeingfor the trust and confidence you at the annual meeting.place in our company.

D. Bryan Jordan

Chairman of the Board,

President and Chief Executive Officer

Notice of Annual Shareholders’ meetingMeeting of Shareholders

April 28, 202026, 2022

10:8:00 a.m. Central Time

The annual meeting of the holders of First Horizon National Corporation’s common stock will be held at 8:00 a.m. Central Time on April 28, 2020, at 10:00 a.m. local time26, 2022 in the Auditorium of the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee 38103.

The items of business are:

| 1. | Election of | |

| 2. | ||

| 3. | Approval of an advisory resolution to approve executive compensation (“say on pay”). | |

These items are described more fully in the following pages, which are made a part of this notice. The close of business on February 28, 202025, 2022 is the record date for the meeting. All holders of record of First Horizon’s common stock as of that time are entitled to vote at the meeting.

This meeting does not relate to the Special Meeting of Shareholders that will be held in connection with our pending merger of equals with IBERIABANK Corporation.acquisition by The Toronto-Dominion Bank, a Canadian chartered bank. A separate proxy statement is being prepared and delivered, and a separate Special Meeting of Shareholders will be held, in connection with the pending merger.that transaction.

Management requests that you vote your proxy by telephone or over the internet or that you sign and return the form of proxy promptly, as applicable, so that if you are unable to attend the meeting your shares can nevertheless be voted. You may revoke a proxy at any time before it is exercised at the annual meeting in the manner described on page 7 of the proxy statement.

Clyde A.A Billings, Jr.

Senior Vice President, Assistant General

Counsel

and Corporate Secretary

Memphis, Tennessee

March 16, 202014, 2022

IMPORTANT NOTICE

Please (1) vote your proxy by telephone, (2) vote your proxy over the internet, or (3) mark, date, sign and promptly mail the form of proxy, as applicable, so that your shares will be represented at the meeting.

If you hold your shares in street name, it is critical that you instruct your broker or bank how to vote if you want your vote to count in the election of directors and the advisory resolution to approve executive compensation (vote item nos. 1 and 23 of this proxy statement). Under current regulations, if you hold your shares in street name and you do not instruct your broker or bank how to vote in these matters, no votes will be cast on your behalf with respect to these matters. For additional information, see page 8 of the proxy statement.

Proxy Statement for 2020 First Horizon National Corporation Annual Meeting

Table of ContentsTABLE OF CONTENTS

| 1 | 2022 PROXY STATEMENT |

PROXY SUMMARY

Please read the entire proxy statement before voting. This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. Page references are supplied to help you find further information in the proxy statement.

| Time and | ||

| The Auditorium of the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee 38103 | ||

| Record | February | |

| Common Shares Outstanding | ||

| Internet | First Horizon uses the SEC’s “notice and access” rule. Notice of internet availability of proxy materials will be sent on or about March | |

| Admission Requirements and COVID-19 Protocols | To attend the meeting in person you will need proof of your stock ownership such as an appropriate brokerage statement and valid photo identification (or other identification acceptable to the company). If you are the legal representative of a shareholder, you must also bring a letter from the shareholder certifying (a) the beneficial ownership you represent and (b) your status as a legal representative. We will determine in our sole discretion whether the letter presented for admission meets the above requirements. For the health and safety of all meeting attendees, if you have not been vaccinated against COVID-19, we ask that you wear a mask and practice social distancing. Though not required of vaccinated individuals, we encourage everyone to wear a mask and practice social distancing where possible. |

| ITEM | ||||||

| Vote Item 1 | Election of directors. We are asking you to elect the | FOR each | ||||

| Vote Item 2 | FOR | 47 | ||||

| Vote Item 3 | Say-on-Pay advisory resolution on executive compensation. In accordance with SEC rules, we are asking you to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. | FOR | ||||

20192021 Performance Highlights

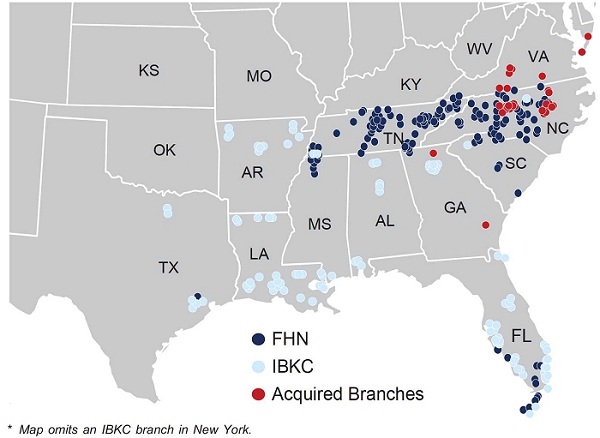

Financial Overview2021 was a year of opportunities and progress for First Horizon. Our July 1, 2020 merger of equals with IBERIABANK Corporation (“IBKC merger”) and July 6, 2020 acquisition of 30 Truist branches nearly doubled our size and helped make us a top-30 U.S. bank ranked by assets. As our associates worked to achieve integration and systems conversion, business momentum began building due to their efforts and commitment.

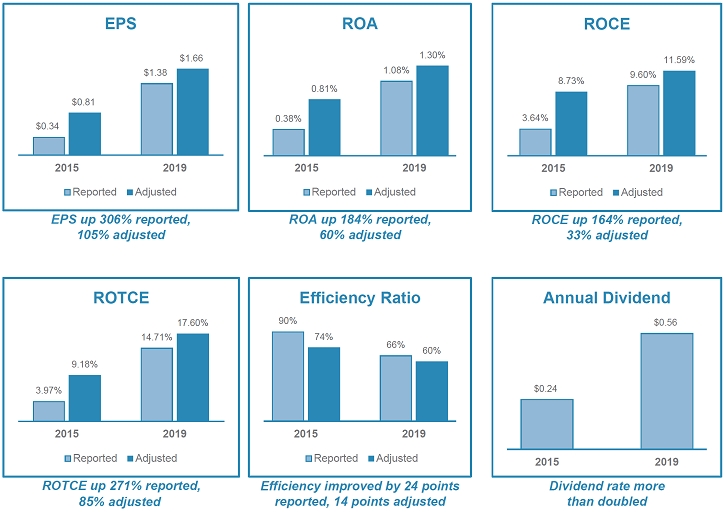

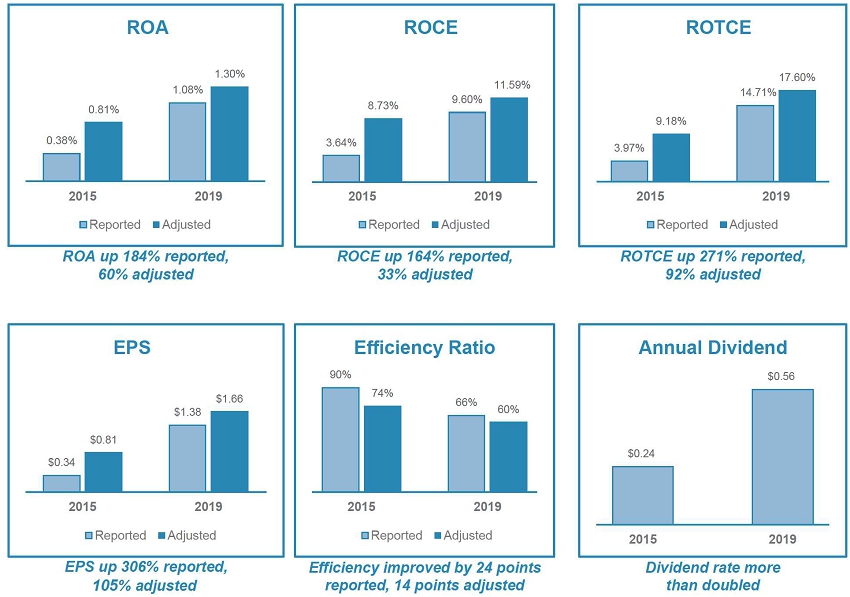

Disciplined Organic Loan & Deposit Growth Drove Excellent Returns in 2019

We grew average loans by 7% and average deposits by 5% in 2019. Loan growth was strongest in the “specialty” commercial lending category, led by loans to mortgage companies. Our net interest margin for the year declined only 0.17% despite federal interest rate reductions totaling 0.75%, while our net

1

| 2 | 2022 PROXY STATEMENT |

charge-off ratio for loans remained very low at 0.09% for the year. In 2019 our fixed income business increased its noninterest income by 69%, and its average daily revenue by 72%, taking advantage of market volatility and falling rates in 2019. During our last Investor Day conference, late in 2018, we presented our “outlook” for 2019. The outlook included two key measures that we use to manage our businesses: return on assets (“ROA”) of 1.20%, and return on tangible common equity (“ROTCE”) of 17%. Our outlook was announced before the Federal Reserve reversed its interest rate policy, from raising rates four times in 2018 to lowering rates three times in 2019. Results for those measures in 2019 are presented below, along with two other commonly-followed measures: return on common equity (“ROCE”) and earnings per share (“EPS”).

In 2019, our adjusted results surpassed our outlook. Key contributors to this success were organic loan and deposit synergies stemming from the Capital Bank merger in 2017, organic loan and deposit growth in our other markets, and disciplined lending and pricing practices.PROXY SUMMARY

*ROTCE2021 Financial Results

While pressure on short-term rates continued and adjustedthe competitive landscape amplified, we delivered better than expected results differ fromaided by strong credit performance and a differentiated, client-focused value proposition with a broader product set. Our solid results reported using generally accepted accounting principles (GAAP). The impacts of mergerreflect the underlying momentum in our balanced business model and restructuring expensesattractive geographic footprint. Non-GAAP results in the text and certain other notable items have been excluded from 2019 adjusted results. Non-GAAP resultstable below are reconciled to GAAP results in Appendix B.

| available to common shareholders of $1.1 billion, up 116% from 2020. These results were driven by the benefits of the IBKC merger, exceptional credit quality as well as a strong focus on deposit cost and expense discipline. | ||

| • | Diluted earnings per common share of $1.74 decreased $0.15, driven by a $0.36 reduction tied to notable items. On an adjusted basis, we grew diluted earnings per common share of $2.07 by 70%. | |

| • | We delivered full year ROTCE of 16.5% compared with 19.0% in 2020 and adjusted ROTCE of 19.3% compared with 12.2% in 2020 and returned $733 million of capital to common shareholders, up 179% from 2020. |

| 2021 Key Financial Highlights | |

| PPNR/Adjusted PPNR | $1.0 billion/$1.2 billion |

| NIAC/Adjusted NIAC | $1.0 billion/$1.1 billion |

| Diluted EPS/Adjusted Diluted EPS | $1.74/$2.07 |

| ROTCE/Adjusted ROTCE | 16.5%/19.3% |

| Average Loans | $56.3 billion |

| Average Loans (excluding PPP) | $52.9 billion |

| Average Deposits | $73.1 billion |

| CET1 Ratio | 9.92% |

| Tier 1 Capital Ratio | 11.04% |

| Total Capital Ratio | 12.34% |

| TBV per Share | $11.00 |

Merger Milestones and Technology Enhancements

As we continued to navigate the effects of the pandemic and disruptive natural disasters in 2021, we completed a number of technology enhancements and achieved critical merger-related milestones:

| • | Onboarded new technology and digital capabilities and upgraded and consolidated operating systems, including wealth and trust, mortgage banking and online banking. | |

| • | Continued to make progress against our targeted merger cost saves with annualized run-rate savings of $104 million in the fourth quarter of 2021, achieving efficiencies to deliver a differentiated client experience across the organization. | |

| • | Identified $45 million of annualized revenue synergies largely tied to commercial loans. |

| • | Maintained associate retention in line with expectations, including leadership/critical positions (approximately 92%). | |

| • | Continued to enhance our culture through regular virtual and in person leadership workshops, culture calls, and team building sessions. | |

2As we look to the future, we are focused on our goals: delivering the benefits of our diversified business model through revenue synergies and loan growth, actively managing capital and the balance sheet, maintaining excellent credit quality and delivering top-quartile ROTCE.

| 3 | 2022 PROXY STATEMENT |

Strategic TransactionsPROXY SUMMARY

30-Branch AcquisitionESG & Compensation Highlights

In the fourth quarterfollowing tables we provide a high-level summary of 2019selected practices, including statistical data, in environmental, social, and governance (ESG) areas or related to executive compensation. The areas were selected based on feedback we announced an agreement to purchase 30 brancheshave received from shareholders in North Carolina (20), Virginia (8), and Georgia (2). We expect the branch acquisition to close in the second quarter this year. Along with the branch locations, we will acquire approximately $0.4 billion of loans and assume approximately $2.4 billion of deposits. The branch transaction will expand our presence in several attractive southeastern markets. The transaction is subject to customary closing conditions.recent years.

IBERIABANK

| Board Composition and Governance | ||

| PRACTICE | FIRST HORIZON | PROXY PAGE NUMBER |

| Number of director nominees | 17 | 36 |

| Independence % of director nominees | 82% (14 of 17) | 15 |

| Independence on key* board committees | 100% | 20 |

| Is there majority voting for directors (in uncontested elections)? | Yes | 7 |

| Must director tender resignation if fails to receive majority vote? | Yes | 36 |

| Average director nominee age | 65 years | 40-46 |

| Average director nominee tenure | 6.5 years | 40-46 |

| Board refreshment | 11 new directors in the past 5 years | 40-46 |

| Does the company disclose a director skills matrix? | Yes | 39 |

| Gender diversity % of director nominees | 24% (4 of 17) | 38 |

| Racial/ethnic diversity % of director nominees | 24% (4 of 17) | 38 |

| Are CEO and Chairman of the Board separate? | Yes | 17-18 |

| Is the Chairman of the Board independent? | No | 15 |

| Is there an independent Lead Director? | Yes | 17 |

| Director terms | All directors are elected for a term of one year | 36 |

| Does the company disclose stock ownership guidelines for directors? | Yes | 62 |

| Mandatory retirement age** | 72, for non-employee directors | 36-37 |

| Retirement age waivers | Board may waive each year for up to 3 additional terms | 36-37 |

| Resignation tender if director has major job change (other than promotion)? | Yes | 36-37 |

| Director nominees on more than two other public company boards | None | 40-46 |

| Annual Board & committee self-evaluations? | Yes | 37-38 |

| Annual individual director evaluations? | Yes | 37-38 |

| Third party engaged to conduct Board and director evaluations? | Yes; every 3 years or as determined by the Nominating & Corporate Governance Committee | 37-38 |

| Director attendance at Board & committee meetings | Average attendance > 96% | 29 |

| Total Board meetings held in 2021 | 6 | 29 |

| Total Board committee meetings held in 2021 | 34 | 29 |

| Do directors meet in executive session without management? | Yes, generally at each regular Board meeting | 29 |

In* Key board committees are Audit, Compensation, and Nominating & Corporate Governance.

* * Under the fourth quarterprovisions of 2019 we announced a merger of equals transaction with IBERIABANK Corporation (“IBKC”), which is the parent company of IBERIABANK based in Lafayette, Louisiana. The combined company, on a September 30, 2019 pro-forma basis and including the 30-branch acquisition, would have had $78 billion in assets, $59 billion in deposits, and $55 billion in loans. A special meeting of our shareholders to vote on the IBKC transaction, including related amendments to our corporate charter, is expected to be held during the second quarter of 2020. None of the matters to be considered at our 2020 regular annual meeting, or discussed in this proxy statement, relate directly to the IBKC transaction. The IBKC transaction is subject to approval by shareholders of both companies, regulatory approvals, and other customary closing conditions. Currently we expect the IBKC merger agreement, the mandatory retirement provisions will not apply to close inany of the second quartercurrent director nominees until after the third anniversary of 2020.

Compensation Highlights (detailed discussion begins on page 48)

Our compensation policies and practices are designed to align the interests of our employees with the interests of our shareholders. We seek to attract, retain, incent, and reward individuals who contribute to our long-term success. We strive to link pay to Company performance for all executive officers, including our CEO. Our compensation practices embrace many best practice corporate governance principles.merger (July 1, 2023).

| AREA | FIRST HORIZON | ||

| Yes | ||

| Dual or multiple class common stock? | No | ||

| Cumulative voting of stock? | No | ||

| Vote required for shareholders to amend Charter | Generally, votes cast favoring exceed votes cast opposing | ||

| Exceptions to general vote requirement in preceding row | 80% for any provision of charter inconsistent with any provision of bylaws or for Article 12 of charter | ||

| Vote required for shareholders to amend Bylaws | 80% | ||

| Shareholder right to act by written consent? | Yes; all shareholders must consent to take action | ||

| Shareholder right to call a special meeting? | Yes, upon demand of holders of 10% of outstanding shares | ||

| Blank-check preferred stock authorized? | Yes | ||

| Blank-check preferred stock outstanding? | Six Series: B, C, D, E, F and

| ||

| Outstanding shareholder

| No | ||

| Proxy access bylaw? |

| ||

3* See our Amended and Restated Charter and our Bylaws, both available on our website at https://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”), for details.

| 4 | 2022 PROXY STATEMENT |

Governance Highlights (a detailed discussion begins on page 10)PROXY SUMMARY

First Horizon is dedicated to operating in accordance with sound corporate governance principles. We believe that these principles not only form the basisOther Governance

| AREA | FIRST HORIZON | PROXY PAGE NUMBER |

| Anti-hedging policy for directors and executives? | Yes | 35 |

| Annual shareholder outreach? | Yes | 12 |

| Code of Business Conduct and Ethics? | Yes | 13 |

| Code of Ethics for Senior Financial Officers? | Yes | 13 |

| Compliance and Ethics Program Policy? | Yes | 13 |

| Board oversight of cybersecurity? | Yes, by Executive & Risk Committee | 18 |

| Audit committee financial experts? | 3 currently serve on Audit Committee | 21 |

| Environmental and Social* | |

| AREA | FIRST HORIZON |

| Diversity, Equity and Inclusion Program? | Yes |

| Board oversight of environmental, social and governance matters? | Yes, by the Nominating & Corporate Governance Committee |

| Chief Diversity, Equity and Inclusion Officer? | Yes |

| ESG Officer? | Yes |

| Human Rights Statement? | Yes |

| Social Issues Statements? | Yes |

| Code of Conduct for Suppliers? | Yes |

| Corporate Social Responsibility working group and task forces? | Yes |

| Corporate Social Responsibility Report? | Yes--most recently published July 2021 |

| Shareholder Outreach on ESG Matters? | Yes |

*See Environmental, Social & Governance Matters on pages 10-13 of this proxy statement, as well as our Corporate Social Responsibility Report, for our reputation of integrity in the marketplace but also are essential to our efficiency and overall success. Some of our corporate governance principles, policies and practices are listed below.additional details.

| Executive Compensation | ||

| AREA | FIRST HORIZON | PROXY PAGE NUMBER |

| Independent consultant for the Compensation Committee | Meridian Compensation Partners, LLC | 25 |

| Frequency of Say-on-Pay vote? | Annual | 49 |

| Clawback policy? | Yes | 62 |

| Clawback features in award plans? | Yes, long-term and annual bonus | 62 |

| Below-market options allowed? | Only in substitution, in a merger, limited to 5% of plan authorization | 53 |

| Stock ownership guidelines for executives? | Yes | 62 |

| Executive-level employment agreements? | None except one with the Executive Chairman of the Board, related to a merger | 77-78 |

| Portion of CEO’s 2021 TDC that is performance-based | 60% | 51 |

| Portion of CEO’s 2021 TDC that is stock-based | 62% | 51 |

| Change in control (CIC) severance program? | Yes; new executive plan & legacy agreements | 75 |

| Single-trigger CIC severance benefits? | No | 75 |

| Range of CIC severance benefit | 1.5 to 3.0 times salary & bonus | 75 |

| Named Executive Officers in CIC severance program | 4 out of 7 | 75 |

| Tax gross-up paid on CIC severance benefit? | Generally no, with one exception from 2007 | 75 |

|  | |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

4

ANNUAL MEETING MATTERS

First Horizon always strives to be Here for Good. We’re honored by the recognition awarded us for our efforts. We are especially proud of the praise we have received for our community service and family-friendly work environment. Here are some of our honors:

World’s Best Banks List

Forbes Magazine, 2019

America’s Best Large Employers List

Forbes Magazine, 2019

Top 50 Companies for Executive Women

National Association for Female Executives, 2019 (received in 2009, and every year since 2012)

Top 100 America’s Most JUST Companies for Corporate Citizenship

Forbes Magazine and JUST Capital, 2019

100 Best Adoption-Friendly Workplaces in America

Dave Thomas Foundation for Adoption, 2019 (every year since 2009)

Diversity Best Practices Inclusion Index

Working Mother Magazine, 2019 (also 2018)

Bloomberg Gender-Equality Index

Bloomberg, 2019 (also 2018 and 2020)

Best Workplaces in Finance and Insurance

Fortune Magazine, 2019

Phoenix-Hecht 2019 Middle Market Quality Index

Excellence in Middle Market Banking

5

2020 Annual Meeting & Proxy Statement—General Matters

Purpose of the Annual Meeting of Common Shareholders

Our Board of Directors is soliciting proxies to be voted at our upcoming annual meeting of the holders of First Horizon’s common stock (and at any adjournment or adjournments of the meeting). At the meeting, our

common shareholders will act

to elect twelve17 directors; to vote on an advisory resolution to approve executive compensation (“say on pay”); and to ratify the appointment of KPMG LLP as our independent auditors for 2020.2022; and to approve an advisory resolution to approve executive compensation (“say on pay”).

Date, Time &and Place of the Annual Meeting

The annual meeting of the holders of our common stock will be held on Tuesday, April 28, 202026, 2022 at 10:8:00 a.m. local timeCentral Time in the Auditorium atof the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee

Tennessee 38103. To obtain additional information or directions to be able to attend the meeting and vote in person, contact our Corporate Communications officetransfer agent at 866-365-4313.(877) 536-3558.

What You Will Need to Attend the Meeting in Person

You will need proof of your share ownership acceptable to the company (such as an appropriate brokerage statement if you hold your shares through a broker) and a form of valid photo identification (or other identification acceptable to the company). If you do not have proof of ownership and acceptable identification, you may not be admitted to the Annual Meeting. If you are the legal representative of a shareholder, you must also bring a letter from the shareholder certifying (a) the beneficial ownership you represent and (b) your status as a legal representative. We will determine in our sole discretion whether the documents presented for admission meets the above requirements.

No cameras, laptops, tablets, recording equipment, large bags, backpacks, briefcases, and similar items are permitted in the meeting room. Cell phones may not be used during the meeting, and we reserve the right to remove individuals who do not adhere to these requirements.

For the health and safety of all meeting attendees, if you have not been vaccinated against COVID-19, we ask that you wear a mask and practice social distancing. Though not required of vaccinated individuals, we encourage everyone to wear a mask and practice social distancing where possible.

Terms Used in this Proxy Statement

In this proxy statement, First Horizon National Corporation is referred to by the use of “we,” “us” or similar pronouns, or simply as “FHN” or “First Horizon,” and First Horizon and its consolidated subsidiaries are referred to collectively as “the company.” First Horizon and IBERIABANK Corporation completed a merger of equals in 2020. IBERIABANK Corporation is referred to in this proxy statement by the use of “IBKC.” The term “shares” means

First Horizon’s common stock, and the term “shareholders” means the holders of that common stock, unless otherwise clearly stated. In addition,

The term “associates” means persons employed by the company. The notice of the 20202022 annual meeting of shareholders, this proxy statement, our annual report to shareholderson Form 10-K for the year ended December 31, 2019,2021, and the proxy card are together referred to as our “proxy materials.” Though the annual report to shareholders is included in the term “proxy materials,” it is not “soliciting material” under SEC Regulation 14A.

Internet Availability of Proxy Materials

We use the SEC’s “notice and access” rule, which allows us to furnish our proxy materials over the internet to our shareholders instead of mailing paper copies of those materials to each shareholder. As a result, beginning on or about March 16, 2020,14, 2022, we sent to most of our shareholders by mail or e-mailemail a notice of internet availability of proxy materials, which contains instructions

on how to access our proxy materials over the internet and vote online. This notice is not a proxy card, and you cannot use it to vote your shares. If you received only a notice, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice.

| 6 | 2022 PROXY STATEMENT |

ANNUAL MEETING MATTERS

If you received a paper copy of the notice, we encourage you to help us save money and reduce the environmental impact of delivering paper notices by signing up to receive all of your future proxy materials electronically.

If you own shares of common stock in more than one account—for example, in a joint account with your spouse

and in your individual brokerage account—you may have received more than one notice. To vote all of your shares, please follow each set of the separate voting instructions that you received for yourthe shares of common stock held in each of your different accounts.

|

Voting by Proxy & Revoking yourYour Proxy

The First Horizon Board of Directors is asking you to give us your proxy. Giving us your proxy means that you authorize another person or persons to vote your shares of our common stock at the annual meeting of shareholders in the manner you direct. Giving us your proxy allows your shares to be voted even if you do not attend the annual meeting in person.meeting. You may revoke your proxy at any time before it is exercised by writing to the Corporate Secretary, by timely delivering a properly executed, later-dated proxy (including by telephone or internet) or by voting by ballot at the meeting. All shares represented by valid proxies received pursuant to this solicitation, and not revoked before they are exercised, will be voted in the manner specified on the proxy.If you submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the recommendations of our Board of Directors as follows:

FOR:

| 1. | Election of |

| duly elected and qualified. Note, however, that | |

| 2. | Ratification of the appointment of auditors. |

| 3. | Approval of an advisory resolution to approve executive compensation (“say on pay”). |

This meeting does not relate to the Special Meeting of Shareholders that will be held in connection with our pending acquisition by The Toronto-Dominion Bank, a Canadian chartered bank. A separate proxy statement is being prepared and delivered, and a separate Special Meeting of Shareholders will be held, in connection with that transaction.

Solicitation of Proxies

First Horizon will pay the entire cost of soliciting the proxies. In following up the original solicitation of the proxies, we may request brokers and others to send proxy materials to the beneficial owners of the shares and may reimburse them for their expenses in so doing. If we deem it necessary, we may also use several of our employeesassociates to solicit proxies from the shareholders, either personally or by telephone, letter or e-mail,email, for which they will receive

receive no compensation in addition to their normal compensation. We have hired Morrow Sodali LLC, 470 West Ave.,333 Ludlow Street, Fifth Floor, Stamford, CT 06902 to aid us in the solicitation of proxies for a fee of $9,000 plus out-of-pocket expenses. An additional charge of $6.50 per holder will be incurred should we choose to have Morrow Sodali LLC solicit individual holders of record.

Quorum & Vote Requirements

Except for our depositary shares (each representing a 1/4000thfractional interest in a share of one of the several series of our non-cumulative perpetual preferred stock, Series A, issued by First Horizon on January 31, 2013)stock), which have limited voting rights and no right to vote at the annual meeting, our common stock is our only class of voting securities. There were 311,787,579533,968,325 shares of common stock outstanding and entitled to vote as of February 28, 2020,25, 2022, the record date for the annual meeting.

Each share is entitled to one vote. A quorum of the shares must be represented at the meeting to take action on any matter at the meeting. A majority of the votes entitled to be cast constitutes a quorum for purposes of the annual meeting. Both “abstentions” and broker “non-votes” will be

considered present for quorum purposes, but will not otherwise have any effect on the vote items.

The affirmative vote of a majority of the votes cast is required to elect the nominees as directors, and we have

| 7 | 2022 PROXY STATEMENT |

ANNUAL MEETING MATTERS

adopted a director resignation policy that requires a director who does not, in an uncontested election, receive the affirmative vote of a majority of the votes cast with respect to his or her election to tender his or her resignation. For additional information on our director resignation policy, see the summary of the policy under Director Resignation and Retirement Policiesin the “Corporate Governance & Board Matters” sectionVote Item 1 of this proxy statement, beginningwhich begins on page 10.36. The policy is also contained in our Corporate Governance

Guidelines, which are available on our website at www.firsthorizon.comhttps://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”).

|

The affirmative vote of a majority of the votes cast is required to approve the advisory resolution on

executive compensation and to ratify the appointment of auditors.

Effect of Not Casting Your Vote

Shares Held in Street Name.If you hold your shares in street name it is critical that you instruct your broker or bank how to vote if you want your vote to count in the election of directors and the advisory resolution to approve executive compensation (vote items 1 and 23 of this proxy statement). Under current regulations, your broker or bank will not have the ability to vote your uninstructed shares in these matters on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your broker or bank how to vote, no votes

will be cast on your behalf with respect to these matters. Your broker

or bank will have the ability to vote uninstructed shares on the ratification of the appointment of auditors (vote item 3)2).

Shareholders of Record.If you are a shareholder of record and you do not vote your proxy, no votes will be cast on your behalf on any of the items of business at the annual meeting unless you attend the annual meeting and vote your shares there.

Duplicate Mailings & Householding

Duplicate mailings in most cases are inconvenient for you and an unnecessary expenditure for us. We encourage you to eliminate them whenever you can as described below.

Multiple Accounts. Some of our shareholders own their shares using multiple accounts registered in variations of the same name. If you have multiple accounts, we encourage you to consolidate your accounts by having all your shares registered in exactly the same name and address. You may do this by contacting our stock transfer agent, Equiniti Trust Company (EQ), by phone toll-free at 1-877-536-3558, or by mail to EQ Shareowner Services, P.O. Box 64854, St. Paul, MN 55164-0854.

Shares Held in Street Name. If you and other members of your household are beneficial owners of shares, meaning that you own shares indirectly through a broker, bank, or other nominee, you may eliminate any duplication of mailings by contacting your broker, bank, or other nominee. If you have eliminated duplicate mailings but for any reason would like to resume them, you must contact your broker, bank, or other nominee.

Shareholders with the Same Address; Requesting Changes. If you are among the shareholders who receive paper copies of our proxy materials, SEC rules allow us to mail a single copy of those materials to all shareholders residing at the same address if certain conditions are met. This practice is referred to as

“householding. “householding.” (HouseholdingHouseholding does not apply to either the proxy card or the notice of internet availability of proxy materials.) If

your household receives only one copy of the proxy materials and if you wish to start receiving separate copies in your name, apart from others in your household, you must request that action by contacting our stock transfer agent, EQ, by phone toll-free at 1-877-536-3558(877) 536-3558 or by writing to it at EQ Shareowner Services, Attn: Householding, P.O. Box 64854, St. Paul, MN 55164-0854. That request must be made by each person in the household who desires a separate copy. Within 30 days after your request is received we will start sending you separate mailings. If you and members of your household are receiving multiple copies and you want to eliminate the duplications, please request that action by contacting EQ using the contact information given in this paragraph above. In either case, in your communications, please refer to your account number. Please be aware that if you hold shares both in your own name and as a beneficial owner through a broker, bank or other nominee, it is not possible to eliminate duplications as between these two types of ownership. If your household receives only a single copy of the proxy materials, and if you desire your own separate copies for the 20202022 annual meeting, you may pick up copies in person at the meeting in April or download them from our website using the website address listed in the box below. If you would like additional copies mailed, we will mail them promptly if you request them from our Investor Relations department at our

|

website or by mail to Investor Relations, P.O. Box 84, Memphis, TN 38101. You may also request that additional copies be mailed by calling our Corporate Communications departmenttransfer agent at

1-866-365-4313. (877536-3558. However, we cannot guarantee you will receive mailed copies before the 20202022 annual meeting.

|

|

ANNUAL MEETING MATTERS

to be held on April 26, 2022 |

| This proxy statement, our proxy card, and our annual report on Form 10-K are available at https://ir.firsthorizon.com/financialdocs. Also available there is a letter to shareholders discussing our 2021 activities and performance. |

Corporate GovernanceCulture & Governance

Our principal business is providing financial services to our clients. Although many financial services can be delivered through technology today, we believe that our clients’ experience with our associates is a critical way we differentiate our company from our competitors. Specifically, we ask our associates to strive consistently to anticipate and respond to client needs and exceed client expectations.

For this “differentiated experience” strategy to succeed, we have to build and nurture a diverse, equitable and inclusive workplace culture that strives to attract, hire, and retain the best people available by compensating and treating them fairly; ensuring that they have opportunities for professional growth and advancement; supporting them with appropriate workplace resources and training; promoting constructive collegiality and a sense of workplace community; encouraging innovation and the development of better ways to address business challenges; recognizing associate achievements, both great and small; and promoting behaviors that provide clients with best-in-class service. At First Horizon, we call this culture “Firstpower.”

As the post-merger integration process has progressed, Firstpower has evolved to incorporate the best aspects of both organizations into the culture of our company. We have developed the following Purpose and Values to guide our associates on our core values and philosophies.

Our Purpose: First Horizon’s purpose is to help our clients unlock their full potential with capital and counsel.

Our Values:

| ▪ | Put Clients First – Go above and beyond to listen, understand and solve the client’s needs. Follow through and exceed expectations every step of the way. | |

| ▪ | Care About People – Treat others with respect and dignity. Foster a culture of collaboration. Demonstrate kindness and empathy for all. |

| ▪ | Commit to Excellence in Everything We Do – Conduct business with professionalism and dignity. Embody a “can do” spirit that gets results for our clients. | |

| ▪ | Elevate Equity – Place equity at the center of our diversity and inclusion efforts. Create accountability and ensure accessibility and opportunity for all. | |

| ▪ | Foster Team Success – Measure wins in terms of “we” not “me.” Take pride in company success. Be invested in a shared vision for future growth. |

Our Action: Own the moment.

We use many tools and resources—programs, events, promotions, communication channels—to nurture and enhance our Firstpower culture. We focus on offering a variety of opportunities that promote mentoring, wellness, internships, diversity, inclusion, volunteering, informal shout-outs and formal recognitions, career management and continuing education, resource groups, and parental and care-giver support.

Our Firstpower culture is a key enabler of First Horizon’s enterprise-wide diversity, equity, and inclusion strategy. Our DEI strategy has a particular focus on elevating equity —an approach that ensures we hold ourselves accountable for quantifying and reducing disparities in accessibility and opportunity based on gender, age, socioeconomic status, sexual orientation, disability status, veteran status, race/ethnicity, etc. We elevate equity through:

| ▪ | Ensuring representation of diverse talent | |

| ▪ | Strengthening leadership capabilities and accountability | |

| ▪ | Fostering inclusion and equality through fairness and transparency | |

| ▪ | Better serving diverse markets and clients | |

| ▪ | Investing in the well-being of communities |

| 9 | 2022 PROXY STATEMENT |

GOVERNANCE & CULTURE

The full Board oversees the company’s DEI strategy and receives periodic reports from management on our DEI efforts.

At December 31, 2021, First Horizon had:

| ▪ | 7,867 associates, or 7,676 full-time-equivalent associates, not including contract labor for certain services: |

| ○ | 69% white, 18% African American, 9% Hispanic, 2% Asian, and 2% other races or ethnicities | ||

| ○ | 63% female and 37% male | ||

| ○ | 2% have disabilities |

| • | 1,215 corporate managers: |

| ○ | 79% white, 12% African American, 6% Hispanic, 2% Asian, and 1% other races or ethnicities | ||

| ○ | 54% female and 46% male | ||

| ○ | 1% have disabilities |

| • | 30 members of the Operating Committee (composed of senior leaders from across the organization): |

| ○ | 73% white, 10% African American, 7% Hispanic, 3% Asian, and 7% other races or ethnicities | ||

| ○ | 43% female and 57% male |

First Horizon strives to strengthen the lives of our associates, clients and communities. We’re honored by the recognition awarded us for our efforts. We are especially proud of the praise we have received for our community service, diversity, equity and inclusion efforts, and family-friendly work environment. Here are some of the honors we’ve received in the past two years:

| World’s Best Banks List Forbes Magazine | America’s Most Just Companies Forbes Magazine | |

| Best Banks to Work For American Banker | U.S. Top 10 Most Reputable Bank RepTrak | |

| Diversity Leader Profiles in Diversity Journal | 100 Best Adoption-Friendly Workplaces in America Dave Thomas Foundation for Adoption | |

| Best Companies for Multicultural Women Working Mother Magazine | Bloomberg Gender Equality Index Bloomberg | |

Environmental, Social & Governance Matters

Our ESG journey is ongoing. We have made progress since the IBKC merger, with several enhancements to our overall ESG practices completed or in progress as described in the chart and narrative on the following pages. We will continue to focus on the ESG issues that

matter most to our business and stakeholders and look forward to sharing our progress in our next Corporate Social Responsibility Report, slated to be published in Summer 2022.

| 10 | 2022 PROXY STATEMENT |

GOVERNANCE & CULTURE

ESG Progress and Opportunities

| Recent Progress | Opportunities in Progress and on the Horizon |

| Governance | |

Strategy. Adopted initial ESG strategy and pillars. Responsibility. • Board assigned Nominating & Corporate Governance Committee with ESG oversight; regular updates at Committee meetings scheduled. • Scheduled regular updates on climate-related risks and opportunities for Executive & Risk Committee. • Incorporated climate risk into statement of risk appetite. • Delegated management responsibility to an ESG Officer. • Established Corporate Social Responsibility working group and task forces. • Engaged ESG advisors. | Measurement. Establish qualitative and quantitative measurements to monitor ESG progress. Implementation. Engage with advisors, working group and task forces to operationalize solutions. Risk management. Incorporate climate risk throughout our risk management processes and policies. |

| Environmental | |

Roadmap. Established a roadmap and framework to achieve sustainability goals. Resources. Engaged climate scientist to advise on environmental matters. Accomplishments. • Completed initial portfolio analysis on climate risk exposure. • Reduce, reuse and recycle initiatives, including becoming a styrofoam free workplace. | Carbon footprint. Calculate our own greenhouse gas emissions and set baseline so that we are positioned to set reduction targets. Environmental initiatives. Work with environmental task force, corporate properties and procurement to assess cost save opportunities and identify measures to improve the resource efficiency of our footprint and activities. |

| Social | |

DEI. • Hired Dr. Hood as Chief DEI Officer. • Launched enterprise-wide DEI Council. • Women appointed to key leadership roles: COO, CFO and CHRO. • Participated in the W.K. Kellogg Foundation’s Expanding Equity program. • Launched 3 new Associate Resource Groups: Hispanic Outreach and Latino Alliance, Eco Champions and Black Inclusion Guild. • Executive Management Committee participated in DEI training at National Civil Rights Museum's Corporate Equity Center. Wellness & Benefits. Continue to provide tools, resources and support to promote associates’ financial, emotional and physical well-being. | Culture. Continue to work toward infusing DEI into our programs and activities, internally and externally. Talent. Focus on increasing underrepresented talent in key business units and leadership roles. CRA. Work to expand access to housing for LMI individuals, support economic development and community revitalization in LMI communities, and improve financial capability and stability in LMI communities. |

| Outreach and Disclosure | |

SASB/TCFD. Began the process of aligning ESG reporting with SASB and TCFD frameworks. Shareholder Outreach. Conducted first proactive corporate governance outreach effort in 2020; continued that outreach in 2021. CSR Report • Published comprehensive CSR Report covering combined company. • Enhanced ESG, environmental, DEI, compliance, political involvement and data privacy and cybersecurity disclosures. | Materiality assessment. Look to conduct ESG materiality assessment with our stakeholders to help us prioritize time and resources. SASB/TCFD. Work toward disclosure aligned with SASB and TCFD frameworks. ESG Ratings. Continue to review and update rating organizations’ data in order to improve scores further. |

Governance. In accordanceApril 2021, First Horizon hired an Environmental, Social and Governance Officer and began work on a more formalized ESG strategy for our company. We adopted our first ESG strategy and pillars, identified near-term priorities, and incorporated climate risk into our statement of risk appetite. The Board charged the Nominating & Corporate Governance Committee with

overseeing the management of and commitment to ESG matters and ESG reporting. That Committee is scheduled to receive updates on ESG matters at every regular meeting, and the Executive & Risk Committee is scheduled to receive regular updates on climate-related risks and opportunities. The Board is also scheduled to receive regular updates on ESG matters, including climate-related

| 11 | 2022 PROXY STATEMENT |

GOVERNANCE & CULTURE

risks and opportunities. Management responsibility was delegated to the ESG Officer, working under the oversight of the Chief Communications Officer. We also established a Corporate Social Responsibility working group and task forces under the leadership of our Chief Communications Officer to review, direct and guide the company’s ESG efforts. Finally, we engaged advisors to help guide our ESG strategy. Going forward, we plan to engage with our Bylaws,advisors, the CSR working group and the various task forces to establish qualitative and quantitative measurements to track and monitor ESG progress and to further develop our ESG pillars and operationalize solutions. We are also working to incorporate climate risk throughout our risk management processes and policies.

Environmental. In 2021, First Horizon is managed underestablished a roadmap and framework to achieve our sustainability goals and hired a climate scientist to advise the direction ofcompany and all corporate powers are exercised by or under the authority of our Board of Directors. Our Board of Directors currently has fourteen members. Allon environmental matters. In addition to opportunities, we are aware of the challenges a changing climate could pose for our business, clients and communities and continue to evaluate these and incorporate them into our risk management framework. We also completed an initial analysis of climate risk exposure in our loan portfolio and became a styrofoam free workplace. Going forward, we plan to work with the environmental task force, corporate properties and procurement to assess cost save opportunities and identify measures to improve the resource efficiency of our directorsfootprint and activities.

Social. Under the leadership of Dr. Anthony C. Hood, our Chief Diversity, Equity & Inclusion (“DEI”) Officer, First Horizon participated in the W.K. Kellogg Foundation’s Expanding Equity program, which is designed to increase diversity, equity and inclusion in corporate America. In addition, our Executive Management Committee participated in a two-day intensive DEI training at the National Civil Rights Museum’s Corporate Equity Center. Under Dr. Hood’s oversight, we will continue to focus on infusing DEI into our programs and activities, internally

and externally, and on increasing underrepresented talent in key business units and leadership roles. Our Community Reinvestment Act area will focus on expanding access to housing for low to moderate income (“LMI”) individuals by financing affordable housing and home rehabilitation programs; supporting economic development and community revitalization in LMI communities by providing small business and commercial financing, technical assistance, job training and creation, and workforce development initiatives; and improving financial capability and stability in LMI communities through banking products and services, volunteerism, financial support for critical community services and financial literacy education programs.

Outreach and Disclosure. Post-merger, we conducted the company’s first proactive corporate governance outreach effort with shareholders and benefited from their feedback and perspectives on a variety of ESG topics. This feedback provided an opportunity to adopt and apply suggestions and practices to best support our business and culture. See Shareholder Outreach immediately following this section for detailed information on our 2021 outreach. We intend to continue our outreach to shareholders on an annual basis going forward and to participate in proactive ESG conversations with shareholders throughout the year. In addition, our ESG team began the process of aligning our ESG reporting with industry-leading frameworks including the Sustainable Accounting Standards Board (“SASB”) and the Task Force on Climate-related Financial Disclosures (“TCFD”). As we move beyond merger integration and systems conversion priorities, we plan to conduct an ESG materiality assessment with participation by our shareholders, associates and clients to help identify issues that represent our most significant and material risks as well as opportunities for enhanced stakeholder value. We also intend to enhance our ESG disclosures with an eye to improving our ESG scores from organizations that rate companies on ESG matters.

We are also directorscommitted to ongoing dialogue with our shareholders, and in the fourth quarter of First Tennessee Bank National Association (the “Bank” or “FTB”).2021 we contacted shareholders representing 54% of our outstanding common shares to offer to engage with them and solicit feedback on areas of interest to them regarding corporate governance.

Lead director Colin Reed, Compensation Committee Chair Rick Maples and members of the legal, compensation, investor relations and ESG teams subsequently held discussions with representatives of firms holding about 18% of our outstanding common shares. The Bank iscomments

and insights they received were shared with the Nominating & Corporate Governance Committee in early 2022 and provided valuable insights into our principal operating subsidiary.shareholders’ perspectives on various topics related to the merger of equals, Board composition, executive compensation, and ESG matters.

Key strategic, compensation, and governance feedback included:

| 12 | 2022 PROXY STATEMENT |

GOVERNANCE & CULTURE

| have made considerable progress in advancing our corporate governance and ESG initiatives. |

| • | Associate retention at all levels is crucial, and executive transitions must be well-managed. | |

| • | Credit quality is critical. We are showing good focus on credit quality and transparency with shareholders. | |

| • | Data security, especially when so many associates work remotely, is an ongoing concern. | |

| • | Our governance and executive compensation programs are strong. | |

| • | Oversight of ESG matters should be a focus for our Board. Some inquired about management’s plans to produce a TCFD report and to incorporate ESG matters into our strategy and ESG metrics into our executive compensation programs. | |

| • | Diversity is important at the board, management and workforce levels. | |

| • | Some noted the need to reduce the size of the Board post-merger via attrition or other options in the future. |

In response to shareholder feedback, we will continue to make adjustments that represent the best interests of our shareholders by:

| • | Continuing to improve transparency and refine our overall corporate governance framework; | |

| • | Consistently reviewing the makeup of our board with a strong focus on ensuring an appropriate level of skills, experience and diversity; | |

| • | Ensuring we have strong board oversight in place regarding risk management with overarching goals of soundness, profitability, and growth, in that order; | |

| • | Further enhancing our compensation framework to help ensure we deliver strong financial performance with appropriate alignment of management and shareholder interests; | |

| • | Fostering an open and inclusive work environment and continuing to advance diversity; | |

| • | Working toward alignment with SASB, TCFD and other disclosure frameworks as appropriate; and | |

| • | Continuing to advance our overall ESG efforts with a goal of delivering for our key stakeholders and driving enhanced long-term shareholder returns. |

First Horizon is dedicated to operating in accordance with sound corporate governance principles. We believe that these principles not only form the basis for our reputation of integrity in the marketplace but also are essential to our

efficiency and overall success. Some of our corporate governance principles, policies and practices are highlighted below.

Corporate Governance Highlights

|

|

Key Corporate Governance Documents

Our Board has adopted the following key corporate governance documents. All of these are available, along with several other governance documents, such as our compensation recovery policy, stock ownership guidelines, and committee charters, on our website at www.firsthorizon.comhttps://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”). Paper copies are also available to shareholders upon request to the Corporate Secretary.

Corporate Governance Guidelines.The Guidelines provide our directors with guidance as to their legal accountabilities, promote the functioning of the Board and its committees, and set forthestablish a common set of

expectations as to how the Board should perform its functions.

Code of Business Conduct and Ethics.This code sets forth the overarching principles that guide the conduct of every aspect of our business. Any waiver of the Code of Business Conduct and Ethics for an executive officer or director must be promptly disclosed to shareholders in any manner that is acceptable under the NYSE listing

standards, including but not limited to distribution of a press release, disclosure on our website, or disclosure on Form 8-K.

Code of Ethics for Senior Financial Officers.This code promotes honest and ethical conduct, proper disclosure of

| 13 | 2022 PROXY STATEMENT |

GOVERNANCE & CULTURE

financial information and compliance with applicable governmental laws, rules and regulations by our senior financial officers and other employeesassociates who have financial responsibilities. We intend to satisfy our disclosure obligations under Item 5.05 of Form 8-K related to amendments or waivers of the Code of Ethics for Senior Financial Officers by posting such information on our website.

We have also adopted a Compliance and Ethics Program Policy, which highlights our commitment to having an effective compliance and ethics program by exercising due diligence to prevent and detect criminal conduct and otherwise by promoting an organizational culture that encourages ethical conduct and a commitment to compliance with the law.

Policy on HedgingRelated Party Transaction Procedures

First Horizon has a policy that prohibits all “pre-clearance persons” from engaging in any activity that hedges an economic interest in First Horizon or Bank stock, unless approved by the CEO or General Counsel, or a designee, in accordance with the policy. To date, no such approval has been granted. For this purpose, a hedge includes any transaction, position, or financial instrument which offsets or ameliorates any decrease in the market value of First Horizon or Bank stock beneficially owned by the pre-clearance person, including any shares owned directly or indirectly as well as any unvested, deferred, or otherwise restricted stock-based awards. “Pre-clearance persons” consist of all executive officers, all First Horizon and Bank directors, all membersThe Audit Committee of the

CEO’s executive management committee, and certain additional employees.

When a person first becomes a pre-clearance person, the person is required to inform the General Counsel of all derivative and short holdings, including any position that would constitute a hedge, which would violate the policy or the procedures if undertaken while the person has pre-clearance person status. Each pre-clearance person further is required to pre-clear any change in his or her derivative and short holdings from time to time other than a change caused by expiration due solely to the passage of time.

Our Board has adopted a director resignation policy that requires a director who does not receiveprocedures for the affirmative voteapproval, monitoring, and ratification of a majority of the votes cast with respect to his or her election to tender his or her resignation. Under the policy, the Nominating & Corporate Governance Committee must promptly consider the resignation tender and a range of

possible responses and make a recommendation to the Board. The Board will acttransactions between First Horizon, on the Nominating & Corporate Governance Committee’s recommendation within 90 days following certificationone hand, and our directors, executive officers or 5% shareholders, their immediate family members, their affiliated entities and their immediate family members’ affiliated entities, on the other hand. A copy of the shareholder vote. Thereafter, the Board will promptly disclose its decision regarding whether to accept the director’s resignation tender,

|

including an explanation of the decision (or the reason(s) for rejecting the resignation offer, if applicable), in a Form 8-K (or other appropriate report) filed with or furnished to the Securities and Exchange Commission. If any director’s tender of resignation under the policyour procedures is not accepted by the Board, such director will serve until the next annual meeting of shareholders and until his or her successor has been duly elected and qualified. Any director who tenders his or her resignation pursuant to the director resignation policy shall not participate in the Nominating & Corporate Governance Committee recommendation or Board action regarding whether to accept the tender of resignation. If a majority of the members of the Nominating & Corporate Governance Committee did not receive the affirmative vote of a majority of

the votes cast at the same election, then all the directors who are “independent” under the listing standards of the New York Stock Exchange and who received the affirmative vote of a majority of the votes cast shall appoint a committee amongst themselves to consider the resignation tenders and recommend to the Board whether to accept them.

This committee may, but need not, consist of all of the independent directors who received the affirmative vote of a majority of the votes cast. The director resignation policy is contained in our Corporate Governance Guidelines, which are available on our website at www.firsthorizon.comhttps://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”). Our procedures require management to submit any proposed “related party transaction” (defined as a transaction that is required to be disclosed in our proxy statement pursuant to the requirements of Item 404(a) of Regulation S-K promulgated by the SEC) or amendment to an existing related party transaction to the Audit Committee for approval or ratification. In some cases, the matter may be determined by the chair of the Audit Committee. In considering whether to approve a given transaction, the Audit Committee (or chair) must consider:

| would apply if the other party was not, or did not have an affiliation with, a director or executive officer of First Horizon; | ||

| • | whether First Horizon is currently engaged in other related party transactions with the related party at issue or other related parties of the same director or executive officer; whether there are demonstrable business reasons for First Horizon to enter into the related party transaction; whether the related party transaction would impair the independence of a director; and | |

| • | whether the related party transaction would present an improper conflict of interest for any director or executive officer of First Horizon, taking into account the size of the transaction, the overall financial position of the director or executive officer, the direct or indirect nature of the interest of the director or executive officer in the transaction, the ongoing nature of any proposed relationship, and any other factors the Audit Committee deems relevant. |

Recent ESG EnhancementsTransactions with Related Persons

First Horizon, made several enhancements to its environmental, socialthe Bank and governance practices between late 2018 and early 2020. These are outlined below.

Adoptionthe subsidiaries of human rights statement and social issues statements (2020).First Horizon’s human rights statement reflects our respect for individual human rights and commitment to operate our companyeach, as applicable, have entered into lending transactions and/or other banking or financial services transactions in an environment where everyone is treated with dignity. Our other social issues statements address other areasthe ordinary course of shareholder and stakeholder concern, including diversity and inclusion and data privacy and cybersecurity.

Adoption of code of conduct for suppliers (2020).This code establishes the business conduct expectations for the company’s suppliers (i.e., third parties that provide goods or services to First Horizon). First Horizon expects its suppliers to comply with applicable laws and regulations and act ethically in all matters related to doing business with our executive officers, directors, nominees, their immediate family members and affiliated entities, and the company.

Adoptionpersons of proxy access (2019).Our proxy access bylaw allows a shareholder or group of up to 20 shareholderswhich we are aware that has held at least 3%beneficially own more than five percent of our common stock, and we expect to have such transactions in the future. Such transactions were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those

prevailing at the time for at least three years to nominate upcomparable transactions with persons not related to the greatercompany, and did not involve more than the normal risk of two directorscollectability or 20% ofpresent other unfavorable features. We note that as a perquisite we offer all associates discounts on certain financial services (for example, no-fee domestic wire transfers). These discounts are available to our executive officers except in relation to credit extended at the Board and have those nominees appear in our proxy statement, subject to notice and other specific requirements in our Bylaws.

Enhanced commitment to corporate social responsibility (2018).Our inaugural Corporate Social Responsibility (CSR) report,Here for Good, which highlights the company’s impact on and outlines its commitment to its communities, employees, and customers, was published in late 2018;time an updated reportexecutive officer is expected to be published in first quarter 2020. The report is available on our website and details First Horizon’s initiatives focused on promoting social and environmental responsibility, building stronger communities, and practicing sound corporate governance. We also established an internal Corporate Social Responsibility Committee, which reviews, directs and guides the company’s environmental, social and governance efforts. The CSR committee provides the CEO, Board of Directors and Executive Management Committee with periodic reports on CSR activities and ESG initiatives. This committee is composed of senior leaders appointed by the CEO and led by the Chief Communications Officer.

Update to individual director evaluation process (2019).Our individual director evaluation process was updated in 2019 to provide that at least every three years, in lieu of the regular evaluation of the directors conducted by the Nominating & Corporate Governance Committee, the company will engage a third party to conduct individual director assessments and to provide advice and reports on how individual directors and the Board can improve.serving as such.

| 2022 PROXY STATEMENT |

BOARD MATTERS

In accordance with our Bylaws, First Horizon is managed under the direction of and all corporate powers are exercised by or under the authority of our Board of Directors. Our Board of Directors currently has 17

members. All of our directors are also directors of First Horizon Bank (the “Bank”). The Bank is our principal operating subsidiary.

Independence & Categorical Standards

Independence

Our common stock is listed on the New York Stock Exchange. The NYSE listing standards require a majority of our directors and all of the members of the Audit, Compensation, Committee, theand Nominating & Corporate Governance Committee and the Audit CommitteeCommittees of the Board of Directors to be independent as defined in the listing standards. Under these standards, our Board of Directors is required to determine affirmatively that a director has no material relationship with the company for that director to qualify as independent. In order to assist in making independence determinations, the Board, upon the recommendation of the Nominating & Corporate Governance Committee, has adopted the categorical standards set forth below. In making its independence determinations, each of the Board and the Nominating & Corporate Governance Committee considered the relationships between each director and the company, including those that fall within the categorical standards. In addition, the NYSE listing standards require that the Board specifically consider certain factors in determining the independence of any director who will serve on the Compensation Committee. These factors are described under the heading “TheThe Compensation Committee—In General” General below in this proxy

statement. Our Board specifically considered such factors in making the

independence determinations for all of our directors, including those who serve on the Compensation Committee. Based on its review and the application of the categorical standards, the Board, upon the recommendation of the Nominating & Corporate Governance Committee, determined that twelve14 of our current non-employee directors (Messrs. Barton, Burdick, Casbon, Compton, Emkes, Foss, Gilchrist, Niswonger,Fenstermaker, Kemp, Maples, Reed, SubramaniamShea, and YancySubramaniam and Mses. Davidson, Palmer, Stewart, and Stewart)Sugrañes) are independent under the NYSE listing standards. The Nominating & Corporate Governance Committee and the Board determined that all transactions and relationships with each director identified aboveNone of Mr. Byrd, as independent fell within our categorical standards. NeitherExecutive Chairman, Mr. Jordan, as our Chief Executive Officer, noror Mr. Taylor, who was employed by First Horizon until November 2019 pursuant to an employment agreement entered into in connection with our merger with Capital Bank Financial Corp., is independent.

The categorical standards established by the Board which were last revised in 2010, are set forth below and are also available on our website at www.firsthorizon.comhttps://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”).

Director Transactions by Category or Type

With respect to each director who is identified above as independent under the NYSE listing standards, the Board considered the following types or categories of transactions, relationships or arrangements in determining the director’s independence under the NYSE standards and our categorical standards.

| and Subramaniam); loans (including mortgage | ||

| • | Provision by an entity affiliated with a director or his or her immediate family member, in the ordinary course of business and on substantially the same |

| 2022 PROXY STATEMENT |

BOARD MATTERS

terms and conditions as those prevailing at the time for comparable transactions with non-affiliated persons, of the following products and services to the company: package delivery and print services (Mr. Subramaniam); hotel lodging for business travel by associates of the company (Mr. Reed); venues for business development and for holding seminars and other corporate functions (Mr. Reed); restaurant meals for business purposes (Mr. Reed); and title insurance and related loan services (Mr. Casbon).

Categorical Standards

Categorical Standards

Each of the following relationships between the Corporation (as defined below) and its subsidiaries, on the one hand, and a director, an immediate family member of a director, or a company or other entity as to which the director or an immediate family member is a director, executive officer, employee or shareholder (or holds a similar position), on the other hand, will be deemed to be immaterial and therefore will not preclude a determination by the Board of Directors that the director is independent for purposes of the NYSE listing standards:

| 1. | Depository and other banking and financial services relationships (excluding extensions of credit which are covered in paragraph 2), including transfer agent, registrar, indenture trustee, other trust and fiduciary services, personal banking, capital markets, investment banking, equity research, asset management, investment management, custodian, securities brokerage, financial planning, cash management, insurance brokerage, broker/dealer, express processing, merchant processing, bill payment processing, check clearing, credit card and other similar services, provided that the relationship is in the ordinary course of business and on substantially the same terms and conditions as those prevailing at the time for comparable transactions with non-affiliated persons. | |

| 2. | An extension of credit, provided that, at the time of the initial approval of the extension of credit as to (1), (2) and (3), (1) such extension of credit was in the ordinary course of business, (2) such extension of credit was made in compliance with applicable law, including Regulation O of the Federal Reserve, Section 23A and 23B of the Federal Reserve Act and Section 13(k) of the Securities and Exchange Act of 1934, (3) such extension of credit was on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons, and (4) the extension of credit has not been placed on non-accrual status. |

| 3. | Contributions (other than mandatory matching contributions) made by the Corporation or any of its subsidiaries or First Horizon Foundation to a |

| charitable organization as to which the director is an executive officer, director, or trustee or holds a similar position or as to which an immediate family member of the director is an executive officer; provided that the amount of the contributions to the charitable organization in a fiscal year does not exceed the greater of $500,000 or 2% of the charitable organization’s consolidated gross revenue (based on the charitable organization’s latest available income statement). | ||

| 4. | Vendor or other business relationships (excluding banking and financial services relationships and extensions of credit covered by paragraph 1 or 2 above), provided that the relationship is in the ordinary course of business and on substantially the same terms and conditions as those prevailing at the time for comparable transactions with non-affiliated persons. | |

| 5. | All compensation and benefits provided to non-employee directors for service as a director. | |

| 6. | All compensation and benefits provided in the ordinary course of business to an immediate family member of a director for services to the Corporation or any of its subsidiaries as long as such immediate family member is compensated comparably to similarly situated associates and is not an executive officer of the Corporation or based on salary and bonus within the top 1,000 most highly compensated associates of the Corporation. |

|

employees and is not an executive officer of the Corporation or based on salary and bonus within the top 1,000 most highly compensated employees of the Corporation.